AML/KYC

Ensuring compliance with Anti-money Laundering (AML) and Know Your Client (KYC) regulations is a very daunting and difficult task. With Regulatory inspections becoming more frequent and the size of fines often significant, Financial Institutions must “get this process right”

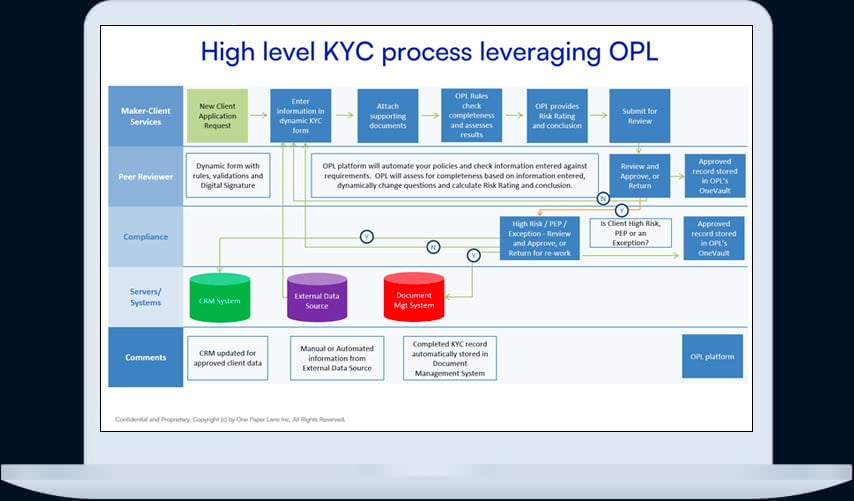

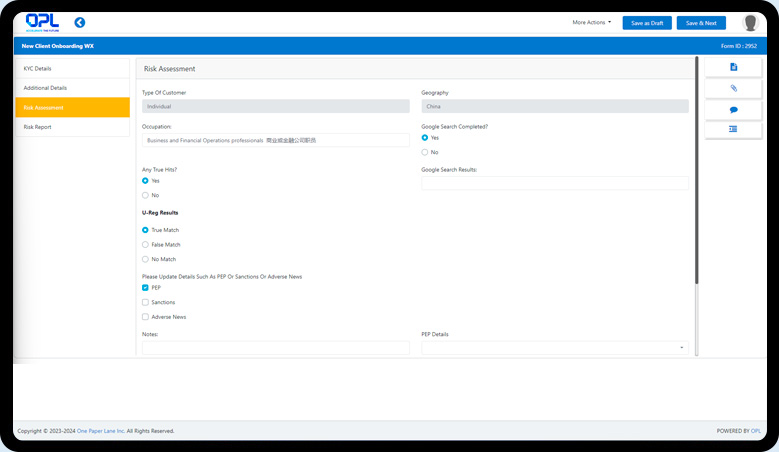

In response to this need, OPL have created a Digital AML/KYC Solution that has the flexibility to be tailored to our customers’ design and policy requirements. Powerful features delivered include:

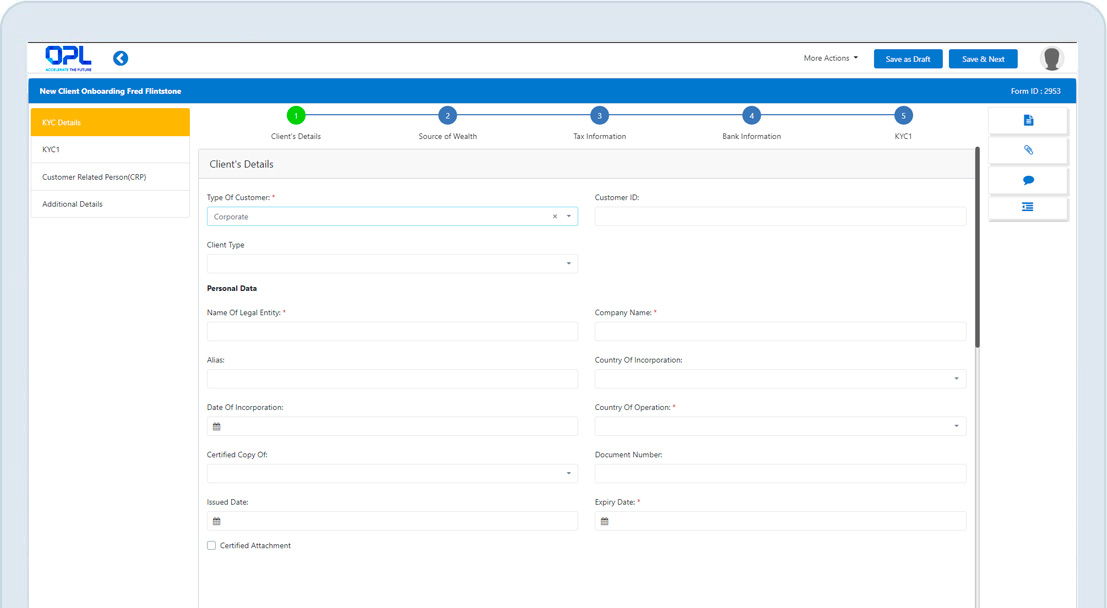

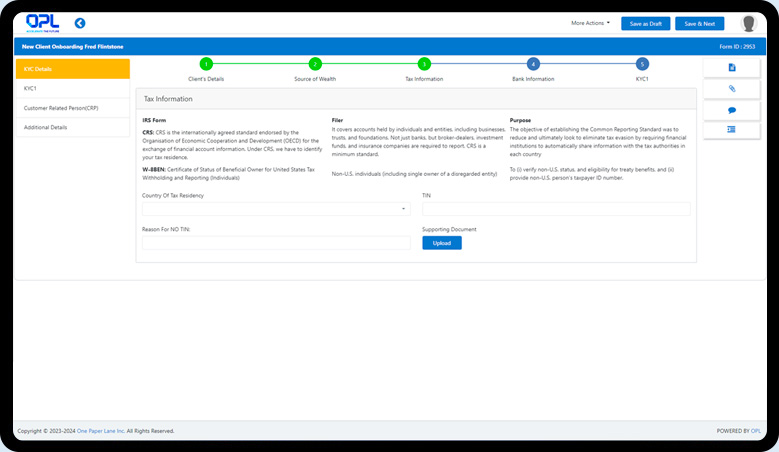

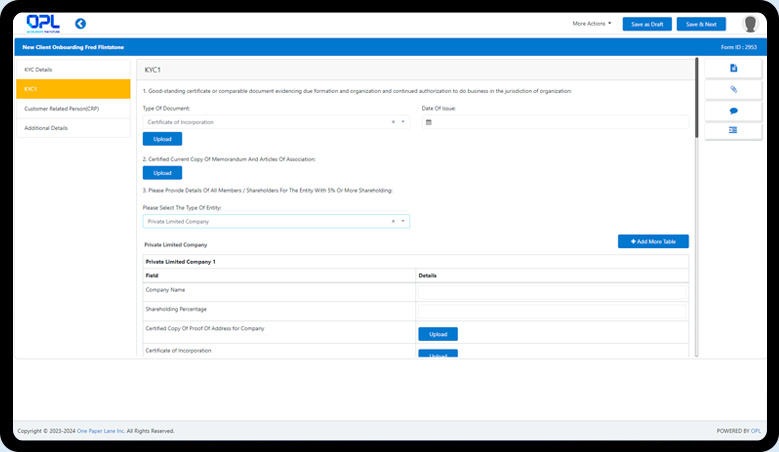

Customer Onboarding and Account Opening forms fully digitized, with dynamic adjustment based on data entered

Digitization of existing KYC policy, or leverage OPL’s pre-configured templates

Automated and dynamic workflow, leveraging OPL’s powerful rules engine

Digital signatures – certified if need be – included with the click of a button

Client Refresh / Periodic Reviews automatically triggered based on policy

Risk Ratings generated using either your own methodology or a number of pre-configured versions

Seamless integration with customer systems or databases to push and pull data

Auto population of data throughout the process into forms and systems – enter only once

Digital customer experience – extend OPL to your customers to enter their data and sign

Transaction Monitoring capabilities

Suspicious Transaction / Unusual Transaction monitoring and reporting capabilities

Seamlessly send data to finance systems, eliminating manual entries

Electronic files created for each client onboarding or periodic review

OneVault included – storage folders with client defined security for your documents

Custom reporting capability to automate your own AML/KYC reports – both internal and external, including Regulatory reports

AML/KYC Case Study

A global PE firm with $58 B in assets under management

One Paper Lane was engaged to digitise the AML/KYC process for fund investors and bring in automation and increased compliance

Problem Statement

Current AML/KYC process was paper, and email driven

Investors needed more guidance on documentation required

AML team found it hard to keep track of information needed

Delays in the compliance process could potentially impact the fund closing schedules

There was a need to mitigate potential risks in the current process

Existing technology setup not able to meet desired goals

The OPL AML/KYC Solution

End to end AML/KYC process digitised

Investors are presented with customised AML/KYC checklists based on their profiles

Client policies are automated into the platform, driving full compliance each time

System prompts on mandated supporting document requirements

Compliance team provided alerts on documentation to be reviewed

Digital templates for each type of checklist made available to all users

Auto alerts for documents that need to be renewed

Ability to seamlessly send data to existing systems eliminating manual entries

Deadline, reminders, approval escalation setting

60%

Faster Processing Time

75%

Improvement in compliance