Asset Management

OPL’s Asset Management solution is uniquely tailored to our clients’ requirements and AML / KYC policy to maximize the Investor experience

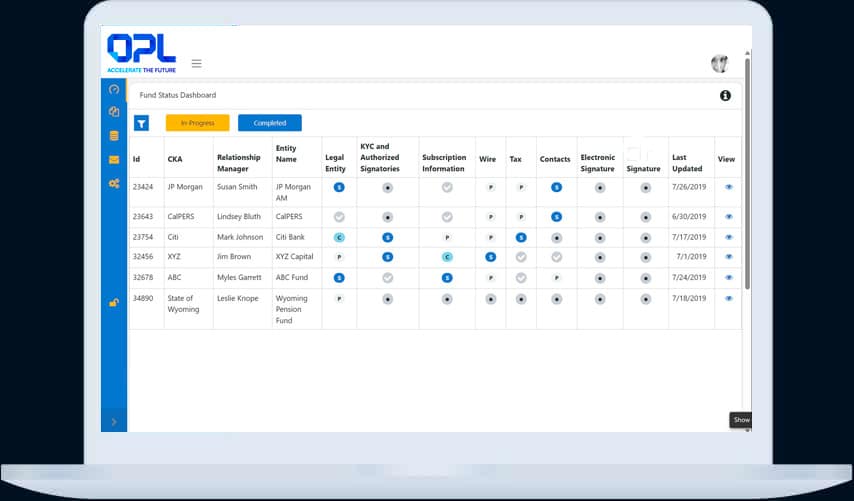

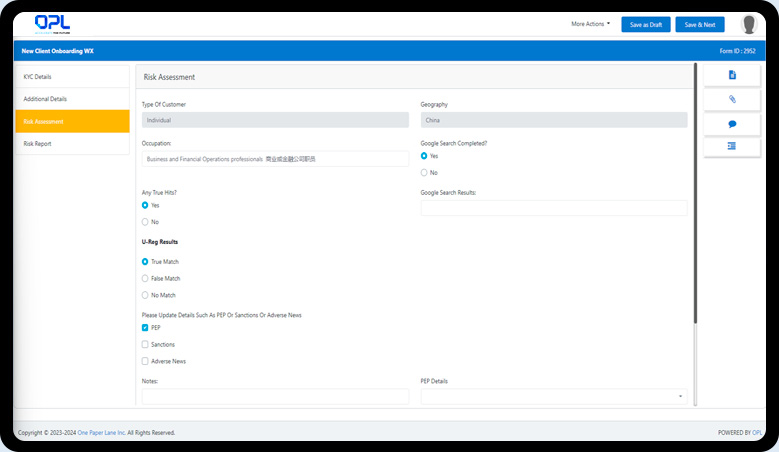

Case Management / Workflow for KYC

Automated workflow / case management solution managing the full KYC process end-to-end in a digital environment

Your AML/KYC policy translated into operational policy within OPL, driving system based checks and improved compliance

Ability for Team Leaders to prioritize Requests and Activities, to ensure the most important / critical tasks are handled first

Full visibility into status of each KYC case by management (based on allocated user access)

You can directly and simply amend the workflow rules / routing / approvers etc without the need for change requests

Automatic triggering of Renewal process for cases based on expiry dates / risk ratings

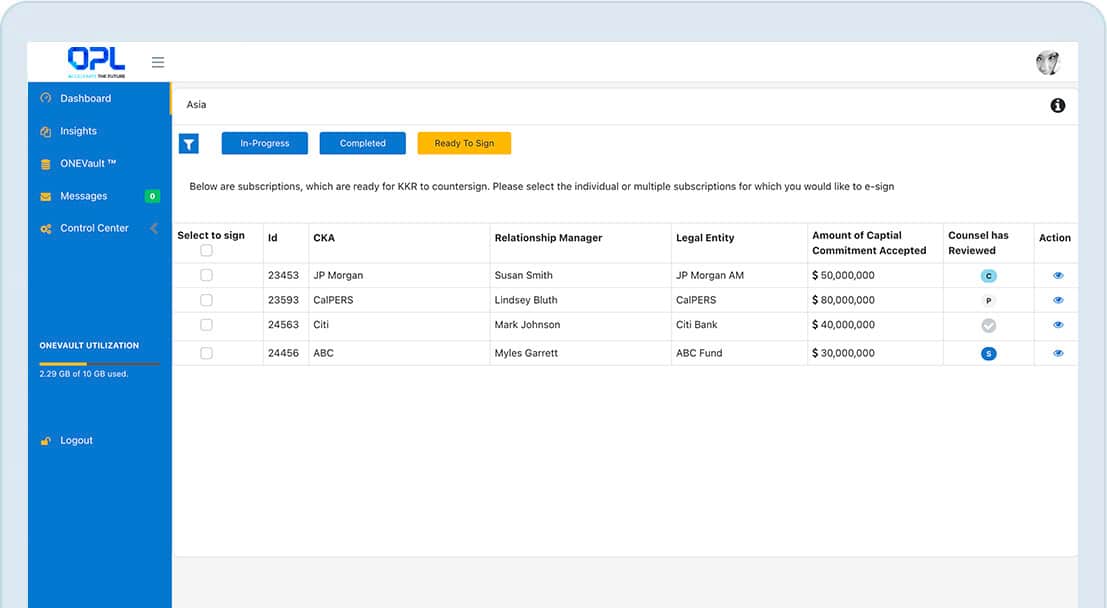

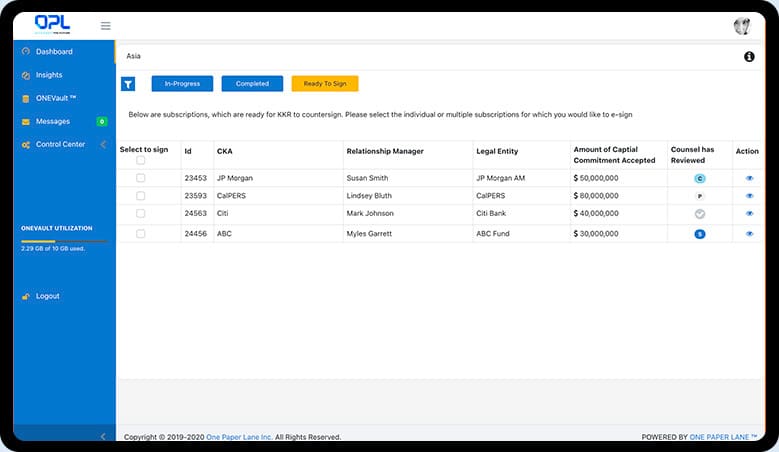

Provision for digital signing of documents / approvals, including certified signatures

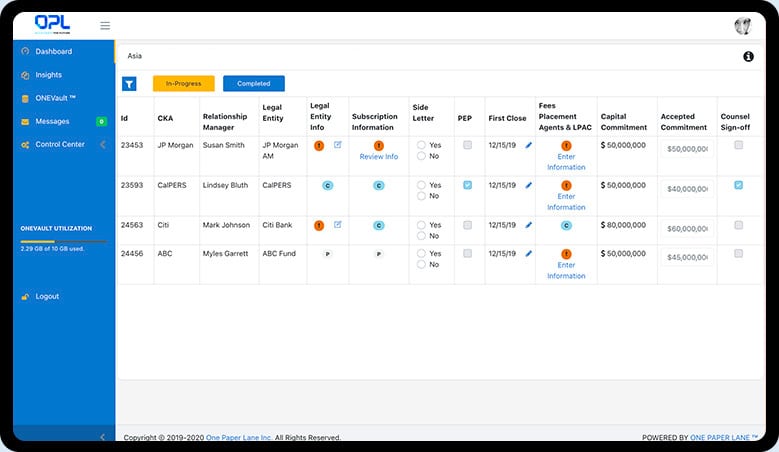

One system to capture the end to end process – allowing you to remove reliance on EUCs and other systems

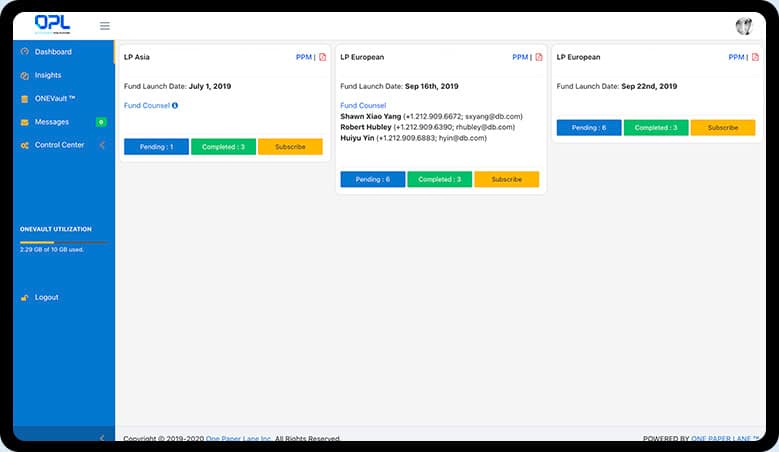

Digital Investment Subscription / Portal

Unique Investor portal allowing clear visibility into investment opportunities, prior transactions, and in-progress subscriptions

Investors update and maintain their contact / user matrix directly in OPL, driving which staff are required to perform activities

Bank wire, taxation, side letter etc details are maintained by the Investor in OPL, increasing user experience and efficiency

Separate customized access / dashboards for external legal, internal legal, customer services and compliance teams

User Experience

Ability to have end clients directly access the platform and enter / update information

Streamlined communication between the different teams, approvers and users, including chat functionality and forums

Dashboards to quickly show progress / activity / issues, with different views to match user’s requirements eg Team Leader

Integration and Data

Integration with your systems, databases as well as external data sources to automatically push and pull data into / from OPL

Strong User Access Management capability to ensure appropriate access and management of users, administrators (SSO)

Process Mining / Analytics built in, to allow visibility into bottlenecks, inefficiencies, process flaws etc

Audit trail reports with time stamp and full details of the activity by users and administrators

Document Management

Digital document storage directly in OPL, to maintain a repository of all documents, information, audit trails, support, approvals etc

OPL Team

More than software – the OPL team will work with you to optimize your processes, investor experience and configure the platform

Strong training and support for your team

KYC, Compliance and Asset Management experts available as needed